Protect Your Credit With Cyrus

See how you can protect your credit and your future with Cyrus Credit Monitoring.

Credit Monitoring

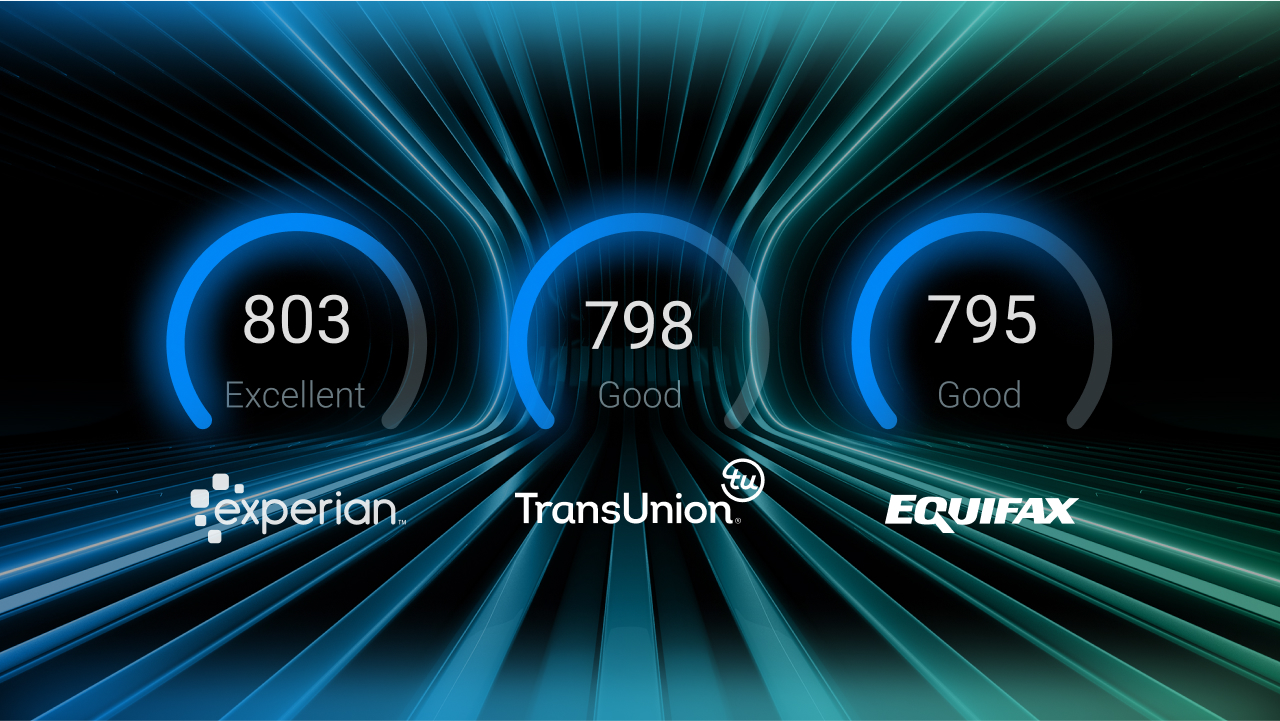

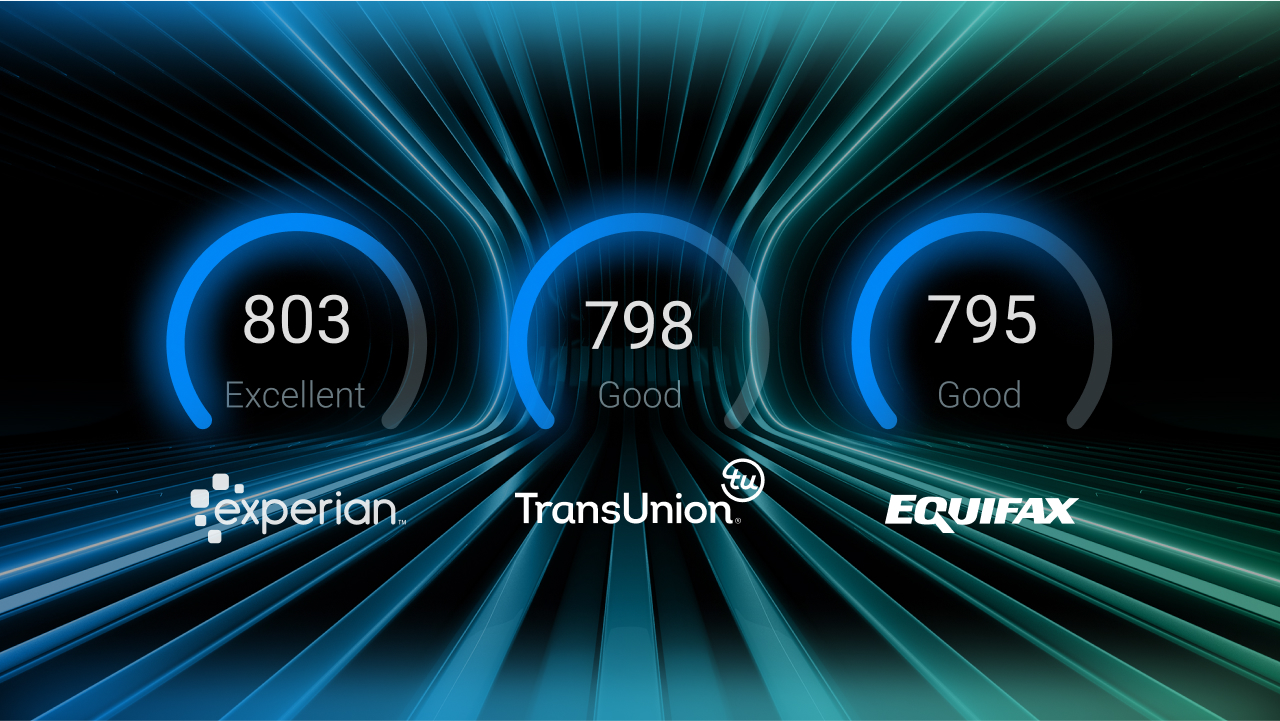

Every time you request a loan or a line of credit, your potential lenders and creditors check your credit score to make sure that you’re good for it. In fact, it’s also customary for banks, landlords, and employers to check credit scores with one of the three official credit agencies – Experian, TransUnion, and Equifax – to gauge the trustworthiness of their customers, tenants, and future employees. For those who don’t know exactly what a credit score is, or aren’t sure how it’s calculated, a credit score is a number denoting your creditworthiness – the higher your credit score, the better. It’s calculated by taking into account your:

- Payment history

- Outstanding balances

- Length of credit history

- Applications for new credit accounts

- Types of credit accounts (credit cards, mortgages, car loans)

The calculations for credit scores are based on credit reports. The more accurate your credit report, the more accurate your credit score will be as well, and its accuracy is super important if you’re job hunting, house hunting, or buying a car. Your credit report includes:

- Your bill payment history

- Loans

- Current debt

- Other financial information

- Your employment history and status

- Your address

- Any legal issues you may have (e.g. if you’d been sued or arrested)

People with a good credit score are more likely to get:

- Loans approved

- Better loan conditions

- Lower loan interest rates

- Lower insurance premiums

That’s why it’s so important to keep your credit safe, ensuring that no one else besides you can open a line of credit in your name.

Credit Monitoring with Cyrus

Credit Monitoring is one of several features offered by Cyrus to keep your online identity safe from identity theft and fraud. Identity theft, unfortunately, doesn’t only happen in the movies. It is, in fact, quite common – once someone has your information they can open up credit cards or take loans out in your name.

By keeping track of credit activities under your name, Credit Monitoring helps to safeguard your credit score, detecting and alerting you of any irregular activity on one of your credit accounts. Javelin’s 2021 Identity Fraud Study reported that identity fraud scams rose to a total of $56 billion in 2020. Activity relating to identity theft can range anywhere from retail or online purchases using a stolen credit card number to taking out a loan using a stolen SSN (or other personal information) without the person’s knowledge.

The biggest issue is that these types of activities are often only detected long after the fact when a person’s credit score has already been negatively affected. As if this wasn’t enough to worry about, there’s also the possibility of your credit card information being compromised through a data breach. Data breaches are becoming very common, so common that a recent analysis shows 45% of US companies have experienced a data breach.

The most common cause of the data breach? Compromised credentials. Since data breaches often result in stolen credit card information, it comes as no surprise that the amount of credit card data available on the Dark Web increased by 135% in 2021. So, if you’re not already keeping a close eye on your credit score and credit reports on a regular basis, you really should start doing it. Alternatively, you could let Cyrus do it for you.

How Cyrus Credit Monitoring works

Cyrus Credit Monitoring guards against identity theft, keeping your personal information safe, tracking changes in your financial activities, and alerting you to potential fraudulent activity. Our goal is to keep any threats to your personal information and assets at bay with our suite of preventative tools. Here’s how to get Credit Monitoring all set up:

- Download the Cyrus app

- Select Credit Monitoring

- Enter your social security number so that Cyrus can verify your identity with the official credit agencies so that Cyrus can monitor for suspicious activities. We only ask for this number for verification purposes and would never use or sell your data.

- Review your credit reports, accounts, and activities to verify that everything you see is legitimate and accurate.

- If you notice any discrepancies or anything that looks suspicious, you can mark it in the app and once you’re finished with your review, you can chat with a Cyrus expert who’ll help you resolve the issue.

- Once you’ve activated Credit Monitoring, Cyrus monitors your credit activity on an ongoing basis to ensure everything is above board. In the event of any suspicious activities, Cyrus will alert you, ensuring that possible problems are discovered as early as possible.

- For an extra layer of security, you can also choose to activate the credit lock feature, which signals to the official credit agencies that no credit accounts can be opened in your name.

Protecting yourself and your personal information online is a must. Let Cyrus be your partner in maximizing your online security, helping you prevent unauthorized access to your accounts so you’ve got peace of mind. Remember, if you don’t take control of your online accounts, somebody else might.